Guide to Avoiding Common Beginner Finance Mistakes

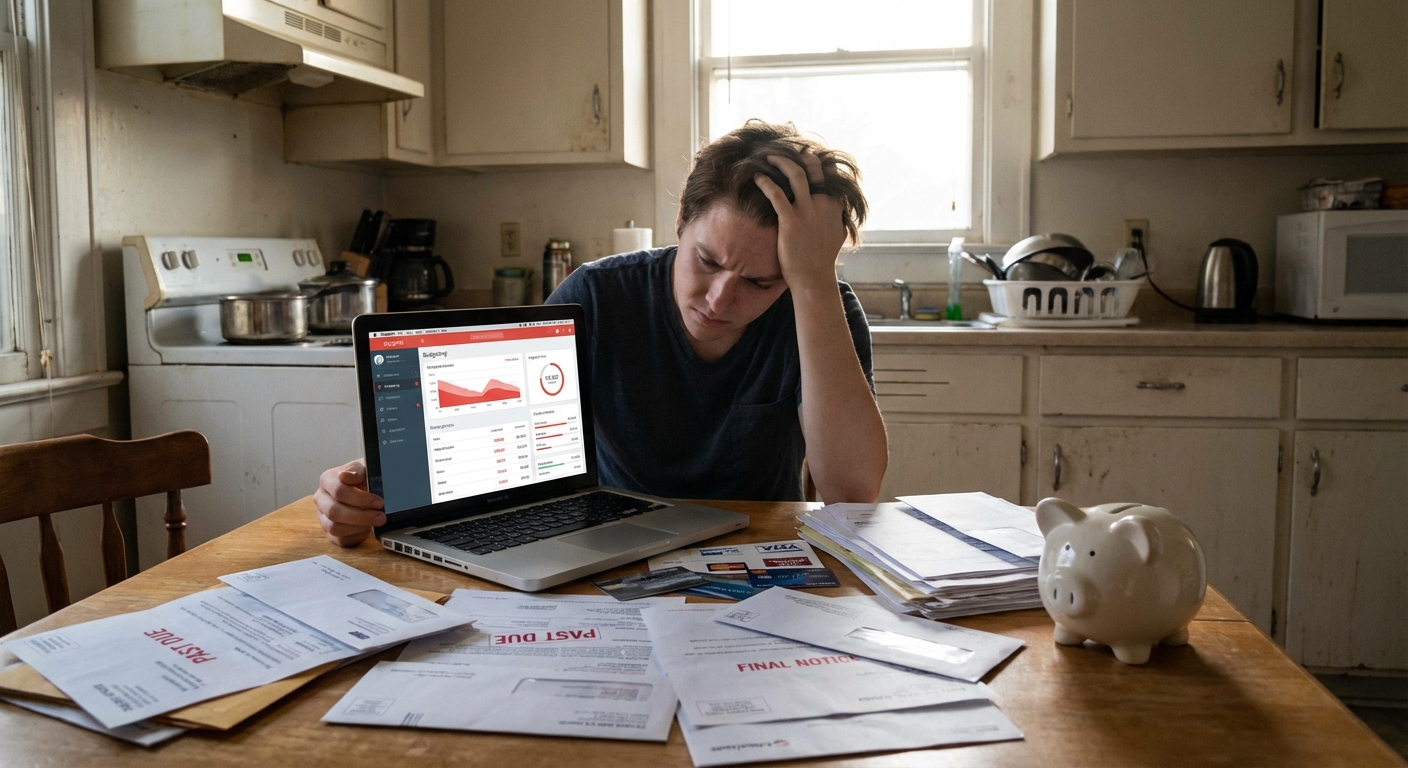

I was standing at an ATM in college, trying to withdraw $40 for a friend’s birthday dinner… and the screen flashed: INSUFFICIENT FUNDS. I’d been “sure” I had at least a couple hundred dollars left. Spoiler: I didn’t.

That little gut-punch kicked off what turned into a years-long obsession with personal finance. I started tracking every expense, binge-reading money books, stress-testing budgeting apps, and, later, talking to actual CFPs (Certified Financial Planners) to sanity-check what I was learning.

This guide is the one I wish someone had shoved into my hands at that ATM.

I’ll walk through the most common beginner mistakes I see (and made myself), how they quietly wreck your finances, and the simple systems I’ve tested that actually work in real life.

Mistake #1: Confusing “Tracking” With “Actually Managing” Money

When I first got into finance, I thought downloading a budgeting app made me financially responsible. I color-coded categories, tagged transactions, and felt wildly productive… while still overspending.

What I learned:Tracking is passive. Managing is active.

In my experience, the turning point wasn’t “seeing” where my money went; it was telling it where to go before the month started.

The simple system that finally worked for me:

- I list my take-home income at the top of a note (after taxes).

- I pre-assign every dollar to a job: rent, groceries, debt, investing, fun, etc.

- I keep a small “chaos buffer” line item (mine is literally called life happens).

This is basic zero-based budgeting, famously popularized by Dave Ramsey and also used in business finance. When I tested this for 90 days, my savings rate jumped from ~3% to about 18% without a salary increase—just fewer “where did my money go?” leaks.

Why this matters: A 2023 Bankrate survey found that 57% of U.S. adults can’t cover a $1,000 emergency with savings. That’s not usually an income problem alone; it’s a cashflow and planning problem.Mistake #2: Treating Debt Like Background Noise

For a couple of years, I treated my credit card balance like a subscription. It was just… there. I’d pay “something” every month. No plan. No urgency.

Then I did the math.

One of my cards was at 22.9% APR. I plugged my balance and minimum payment into an online calculator and realized I’d be paying years longer and thousands more in interest if I kept coasting.

Two approaches I’ve tried (and seen work):- Debt Snowball – Pay off the smallest balance first for motivation, then roll that payment into the next debt.

- Debt Avalanche – Pay off the highest interest rate first to minimize total interest paid.

When I tested both, the avalanche method saved me more money, but the snowball felt more motivating. What I ended up doing was a hybrid: I focused on a mid-sized, high-interest card first, so I got both a win and real savings.

What most beginners miss:- High-interest credit card debt (20%+ APR) almost always beats stock market returns in the worst way possible.

- Paying off a 20% APR card is essentially like getting a risk-free 20% return on your money. Even Warren Buffett doesn’t promise that.

If you’re juggling multiple cards, I’ve seen it really help to:

- Line up all debts in a simple spreadsheet: balance, APR, minimum payment.

- Pick a primary target and automate extra payments there.

- Keep making minimums on everything else to protect your credit score.

Mistake #3: Waiting Too Long to Start Investing

I used to think investing was for “later,” like some future version of me who wore blazers unironically.

When I finally ran compound interest calculations, I felt physically ill.

Here’s the scenario that converted me, based on numbers close to what I used:

- Person A invests $300/month from age 25 to 35, then stops and never invests again.

- Person B invests $300/month from age 35 to 65.

Assuming a 7% average annual return (roughly aligned with long-term stock market returns after inflation), Person A often ends up with more money at 65

—even though they invested for only 10 years vs. Person B’s 30 years. That’s the power of compounding.

Vanguard has historical data showing that from 1926–2022, a 100% stock portfolio returned about 10% annually before inflation on average. You obviously won’t get that every year, but over decades, it smooths out.

What I wish I’d done sooner:- Opened a low-cost index fund or ETF in a tax-advantaged account like a 401(k), IRA, or Roth IRA.

- Automated a fixed monthly amount—even if it was just $50 at first.

- Ignored the day-to-day noise and focused on time in the market, not timing the market.

I’m not anti-stock-picking, but when I compared my early “clever” picks to a simple S&P 500 index fund over five years… let’s just say my ego lost.

Mistake #4: Ignoring the Boring-but-Critical Safety Net

The least sexy part of finance is the one that’s saved my sanity the most: emergency funds and basic insurance.

I once got hit with an unexpected medical bill that was almost exactly the amount of my then-emergency fund. It hurt—but it didn’t wreck me. Past me, who had grudgingly set that money aside instead of buying a new laptop, got a silent thank you.

What’s worked well for me:- Aim for 3–6 months of essential expenses in a high-yield savings account.

- Keep it separate from daily spending so you’re not tempted to “accidentally” use it.

- Pair it with the boring stuff: health insurance, renter’s/homeowner’s insurance, and if others depend on your income, term life insurance.

The Federal Reserve’s 2023 report on U.S. household well-being found that about 37% of adults would struggle to cover a $400 emergency. That’s exactly the kind of situation an emergency fund is built for.

Is it fun watching cash sit there not “working” for you? Not really. But from a risk-management perspective, it’s like armor. You don’t appreciate it until something hits you.

Mistake #5: Forgetting That Lifestyle Creep Is Real (and Sneaky)

The first time I got a real raise, I mentally earmarked it for savings. Then suddenly I had nicer takeout, a more expensive gym membership, and somehow a higher Uber bill every month.

My savings rate? Barely moved.

Economists call this lifestyle inflation—your spending automatically rises as your income does. I’ve seen it over and over in friends who “make good money” but feel perpetually broke.

What’s worked better for me is pre-committing:

When my income increases, I automatically route a percentage of that raise into:

- Retirement accounts (401k, IRA/Roth IRA)

- A taxable brokerage account for long-term investing

- Short-term goal buckets (house fund, travel fund, etc.)

I literally never see that money in my checking account, so my brain doesn’t register it as “spendable.” The 50/30/20 rule (50% needs, 30% wants, 20% saving/investing) can be a decent starting benchmark, but I think of it as training wheels, not gospel.

Mistake #6: Chasing Hacks Instead of Building Systems

I went through a phase where I was obsessed with money “hacks”: rewards cards, bank bonuses, travel points. Some of that’s great—I still love a good sign-up bonus.

But here’s what I realized when I zoomed out:

The big wins came from systems, not hacks.

When I talked with a financial planner friend, they broke down wealth-building into three brutal but clear levers:

- Spend less than you earn (and know the actual numbers).

- Grow the gap (increase income and control lifestyle creep).

- Invest the gap consistently in productive assets over a long time (stocks, bonds, businesses, real estate, etc.).

Everything else is garnish.

These are the systems I keep coming back to:

- Automation: Bills, savings, and investing happen on autopilot right after payday.

- Monthly money check-in: I spend 20–30 minutes once a month reviewing accounts, goals, and any weird charges.

- Annual “big picture” review: Once a year I check asset allocation, fees, insurance coverage, and major goals.

When I tested this “systems-first” approach against my old “wing it and chase hacks” phase, my net worth chart started looking a lot less like a drunk roller coaster and more like a gradually climbing line.

Mistake #7: Letting Shame or Confusion Keep You Stuck

I’ve had nights staring at my bank app, feeling like everyone else got a secret manual on money except me.

Here’s the unflattering truth from my own experience and from talking to dozens of people about this:

Almost no one is naturally good with money. Most of us learned by messing it up first.

Where I’ve seen people make the fastest progress is when they:

- Get curious instead of judgmental about their past behavior.

- Use numbers as feedback, not a verdict on their worth.

- Ask “What’s the next smallest, most boring step I can take?”

That might mean:

- Finally opening that 401(k) at work and choosing a target-date fund.

- Calling your credit card company to negotiate a lower APR.

- Moving your emergency fund from 0.01% interest to a high-yield savings account.

None of that is glamorous. But stacked over years, it completely changes your trajectory.

A Quick Recap You Can Screenshot

From my own trial-and-error (plus a lot of expert reading and facepalming), here’s the short version:

- Don’t just track money—assign every dollar a job before the month starts.

- Attack high-interest debt with a clear strategy (snowball, avalanche, or a mix).

- Invest early and consistently; compounding beats clever timing.

- Build a boring emergency fund and carry basic insurance; future you will be grateful.

- Watch for lifestyle creep when your income rises—automate saving the raise.

- Focus on systems over hacks; automation and regular check-ins do the heavy lifting.

- Drop the shame; treat this like a skill you’re learning, not a test you already failed.

I recently looked back at that broke-college-kid ATM moment and realized something: the gap between that version of me and the current one isn’t willpower or intelligence. It’s a handful of simple, repeatable habits that I stuck with long enough for compounding to kick in.

You don’t need to become a finance nerd to avoid the big beginner mistakes. You just need a basic plan, a bit of patience, and the willingness to start while things still feel messy.

Sources

- Bankrate: Most Americans can’t cover a $1,000 emergency expense - Data on emergency savings statistics.

- Vanguard: Historical investment returns for stocks, bonds, and cash - Long-term market return data.

- Federal Reserve: Economic Well-Being of U.S. Households in 2023 - Statistics on financial resilience and emergencies.

- U.S. Securities and Exchange Commission (SEC): Saving and Investing - Official guidance on saving and investing basics.

- Consumer Financial Protection Bureau (CFPB): Credit card interest and payoff strategies - Information on managing and paying down credit card debt.