Writing Your Will: Key Decisions to Consider

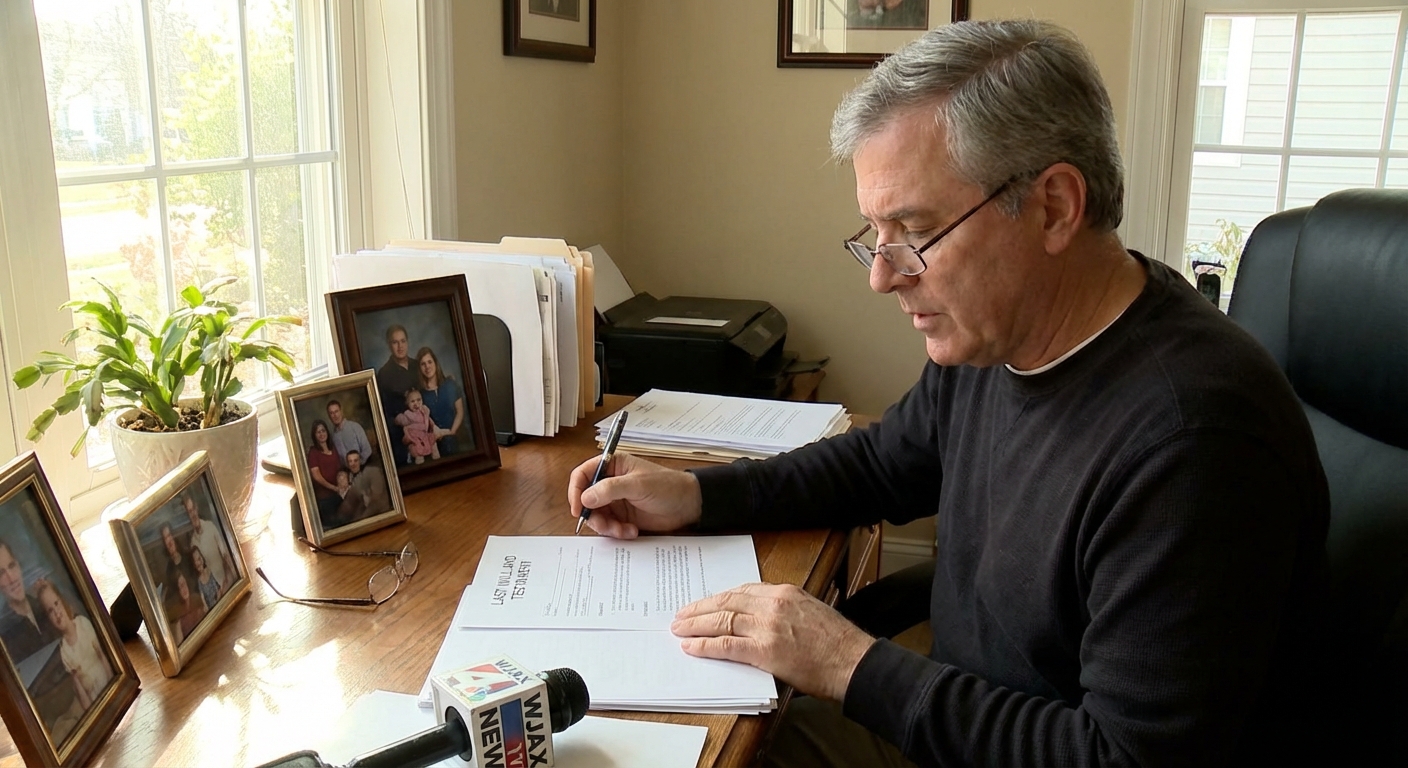

fight through two years of legal chaos after a sudden death in their family — no will, no clear wishes, lots of arguments. That experience snapped me awake.

I booked an appointment with an estate planning attorney the same week.

When I walked into that office, I thought I just had to “say who gets my stuff.” What I discovered is that a will is less about stuff and more about clarity, control, and kindness to the people you leave behind.

Here’s what I learned — and what I wish I’d known earlier.

Step One: Decide Who Actually Gets What

The first big decision is the one everyone expects: beneficiaries.

When I first tried this on my own (yes, I printed one of those free templates), I wrote something hilariously vague like, “My assets go to my family.” My attorney smiled and said, “That’s how lawsuits are born.”

You need to:

- Name specific beneficiaries: people and/or organizations.

- Decide what they receive: a percentage of your estate or specific assets.

- Think about backup beneficiaries in case someone dies before you.

For example, I split things like this:

- A fixed percentage to specific family members

- A small share to a charity I care about

- A backup plan that says, “If X isn’t alive, their share goes to Y.”

In legal terms, you’re deciding your distribution scheme:

- Per stirpes: your beneficiary’s share passes down to their descendants if they die before you.

- Per capita: that share is split among the surviving named beneficiaries instead.

When I tested different scenarios with my lawyer (“What if my sibling dies before me but has kids?”), per stirpes made more sense for my situation. For someone else, per capita might be cleaner.

There’s no universal right answer — just clarity or confusion. You’re choosing which one your family gets.

Choosing Your Executor: The Most Underrated Decision

I thought the executor was a ceremonial role. Nope. It’s work.

Your executor is the person (or people) who:

- Files your will with the court

- Works through probate (the legal process of validating the will)

- Pays off debts, files final tax returns

- Distributes assets according to your instructions

In my experience, people pick executors for the wrong reasons: oldest child, closest friend, “the responsible one” without asking them.

When I looked at my own life, the person I loved most was not the person who’d be best at dealing with banks, forms, and the occasional angry relative.

What worked better for me:

- I chose someone organized, calm, and mildly stubborn

- I asked them directly, “Are you willing to do this?”

- I named a backup executor, in case they can’t or won’t do it when the time comes

You can also appoint a professional fiduciary or corporate executor (like a bank trust department). Pros: expertise, neutrality. Cons: fees and less personal touch. For large or messy estates, that trade-off might be worth it.

If You Have Kids, Don’t Skip Guardianship

The hardest part of my will was not the money; it was deciding who would raise my child if I couldn't.

Legally, you can use your will to nominate a guardian for minor children. The court has the final say, but judges give huge weight to your written wishes.

When I talked to parents who’d already done this, a pattern emerged:

- They didn’t pick the richest relative.

- They didn’t always pick the closest one geographically.

- They picked the person whose values and parenting style most closely matched theirs.

I went through a mental checklist:

- Who actually has the energy and emotional bandwidth?

- Who shares my general approach to discipline, education, and screen time?

- Who could realistically create a stable environment?

Then came the awkward part: asking them. I literally said, “This is a heavy question, but if something happened to me, would you be willing to be my child’s guardian?”

They said yes, but I also wrote a backup guardian, just in case their life circumstances change.

The hard truth: if you don’t make a choice, the court will. And it may not be the person you’d have picked.

What Your Will Doesn’t Control (This Surprised Me)

One of the most eye‑opening moments in my estate planning journey was realizing how many things my will doesn’t govern.

Some assets pass outside of your will by default:

- Life insurance payouts

- Retirement accounts (401(k), IRA, etc.)

- Some bank or investment accounts with transfer-on-death (TOD) or payable-on-death (POD) designations

- Property owned jointly with rights of survivorship

These pass based on the beneficiary designations on the account paperwork, not what your will says.

My lawyer told me a real case (no names, obviously): an ex‑spouse stayed on a retirement account as beneficiary because the person never updated their forms after a divorce. The will left everything to the new spouse. The beneficiary designation won. The ex got the retirement money.

That story sent me straight to my accounts to update beneficiaries.

If you’re writing a will, pair it with a quick beneficiary audit:

- Check every life insurance policy

- Check every retirement account

- Check any POD/TOD bank accounts

Your will and your designations should tell the same story.

Specific Gifts vs. “The Rest of It” (Residuary Estate)

At first, I wanted to itemize everything: “My bookshelf to A, my guitar to B, my camera to C.” It felt sentimental.

Then my attorney gently asked, “Are you sure you want to force your executor to track down individual items for 20 different people?”

That’s when I learned about two key concepts:

- Specific bequests: Named items or sums of money (“$5,000 to my niece,” “My ring to my sister”).

- Residuary estate: Everything left after those specific gifts, taxes, and debts.

In my experience, it’s cleaner to:

- Make a few meaningful specific gifts (items with real emotional or financial value)

- Then decide how to split the residue (e.g., “The rest of my estate goes 60% to X, 40% to Y”)

The risk of over‑doing specific bequests is practical chaos, especially if things are sold, lost, or replaced before you die. Then your executor has to guess what you “would’ve wanted.”

I now only list items I truly care about directing — everything else flows into the residuary pot.

Balancing Fairness and Reality (This Is Where Families Fight)

One of the most uncomfortable parts of this process was realizing that “equal” and “fair” aren’t always the same thing.

A few real examples I bumped into while researching and talking to professionals:

- One child has permanent special needs and will always require support.

- One sibling already received a large financial gift (e.g., help with a house).

- One adult child is terrible with money, the other is financially stable.

Estate lawyers see this stuff all the time. The solution isn’t always a simple 50/50 split. Sometimes it’s:

- Different inheritance amounts with a written letter of explanation (not legally binding, but emotionally helpful)

- Setting up a trust for someone who needs long‑term oversight, instead of leaving them a lump sum

When I tested different options on paper, a slightly uneven distribution actually matched my values better — if paired with a clear explanation.

There’s a risk here: unequal distributions can create resentment. But silence can create even more. Many estate planners now recommend having at least a partial conversation with key family members, so your will doesn’t feel like a surprise grenade.

DIY vs. Lawyer: What Actually Makes Sense?

I experimented both ways: I tried an online will tool first, then took that draft to an estate planning attorney to review.

Here’s what I found:

DIY / Online will pros:- Cheap or even free

- Fast — you can do it in an evening

- Better than nothing if you’d otherwise do nothing at all

- Easy to leave out critical clauses (like residuary clauses, guardianship backups, or tax language)

- Risk of state‑specific requirements not being met (e.g., witness rules, notarization, self‑proving affidavits)

- No human to ask, “Hey, does this make sense for my situation?”

- Custom advice for your state’s laws

- Coordination with other tools (trusts, powers of attorney, healthcare directives)

- They’ve seen all the weird family scenarios you haven’t thought of yet

- Cost — for a basic will package, I’ve seen ranges from $300–$1,500+ depending on where you live and how complex things are

My honest view:

- If you’re young, single, with few assets: a reputable online will + updated beneficiary forms is way better than nothing.

- If you have kids, property, a business, or complicated family dynamics: a local estate planning attorney is worth the money.

Don’t Forget the Boring but Crucial Formalities

I nearly messed this part up.

Wills aren’t just about wording — they’re about execution formalities. In the U.S., these vary by state, but usually include:

- Being of sound mind when you sign

- Signing the will in front of witnesses (often two)

- Witnesses usually shouldn’t be beneficiaries

- Some states allow a self‑proving affidavit, notarized, which makes probate smoother because the court doesn’t have to track down witnesses later

I almost had a close friend (who’s also a beneficiary) act as a witness. My attorney stopped that instantly.

If you’re doing this without a lawyer, I strongly recommend checking your state’s requirements on an official site, not just a blog.

Updating Your Will: It’s Not a One‑Time Project

When I finished my will, I felt this wave of relief. Then my attorney said, “We’ll probably revisit this in 3–5 years or after any major life event.”

Wills aren’t tattoos. They’re drafts of your current best plan.

Common triggers to review or update:

- Marriage, divorce, or new long‑term partner

- Birth or adoption of a child

- Death of a beneficiary or executor

- Major financial changes (selling a business, large inheritance, big move)

- Changing your mind about who should be in charge

The mistake a lot of people make is treating the first draft as final. In my experience, the most mentally freeing mindset is: “This is my best version for right now. I can change it later.”

The Real Point of a Will

After going through this process myself, here’s what it comes down to:

A will is not primarily about money. It’s about:

- Reducing the emotional and logistical burden on the people you care about

- Avoiding unnecessary court drama and legal fees

- Making sure the story of your life’s work ends the way you’d want

It’s uncomfortable. It’s also one of the most generous documents you’ll ever create.

If you’ve been putting it off, you’re not alone. But the day I signed mine, I slept better. And honestly, that alone was worth the effort.

Sources

- Consumer Financial Protection Bureau – Estate planning and wills - Federal guidance on wills, probate, and estate basics.

- American Bar Association – Wills: Why You Should Have One and What It Should Include - Overview from a leading professional legal organization.

- Cornell Law School Legal Information Institute – Wills - Plain-language legal definitions and explanations.

- USA.gov – Managing someone else’s money and property - Government resource on executors and fiduciary responsibilities.

- Harvard Law School – Basic Estate Planning FAQ - Educational overview of estate planning tools and concepts.