Guide to Online Vehicle Auctions for Seized and Used Cars: Bidding Steps and Fees

government vehicles and bank repos on a Sunday afternoon… and won a car for less than half its book value.

That first win was messy. I paid fees I didn’t expect, misread the condition report, and nearly missed the pickup deadline. So this guide is basically the playbook I wish I’d had the first time I clicked “Bid.”

I’ll walk you through the full process for online auctions of seized and used vehicles, what the fees really look like, how bidding works, and where people get burned.

Where These Cars Actually Come From

When I started digging into this, I realized “auction car” can mean several very different things:

1. Government- and Police-Seized Vehicles

These are vehicles taken due to unpaid taxes, criminal activity, or civil forfeiture. In the U.S., you’ll often find them on:

- GovDeals, GSA Auctions, local sheriff auctions

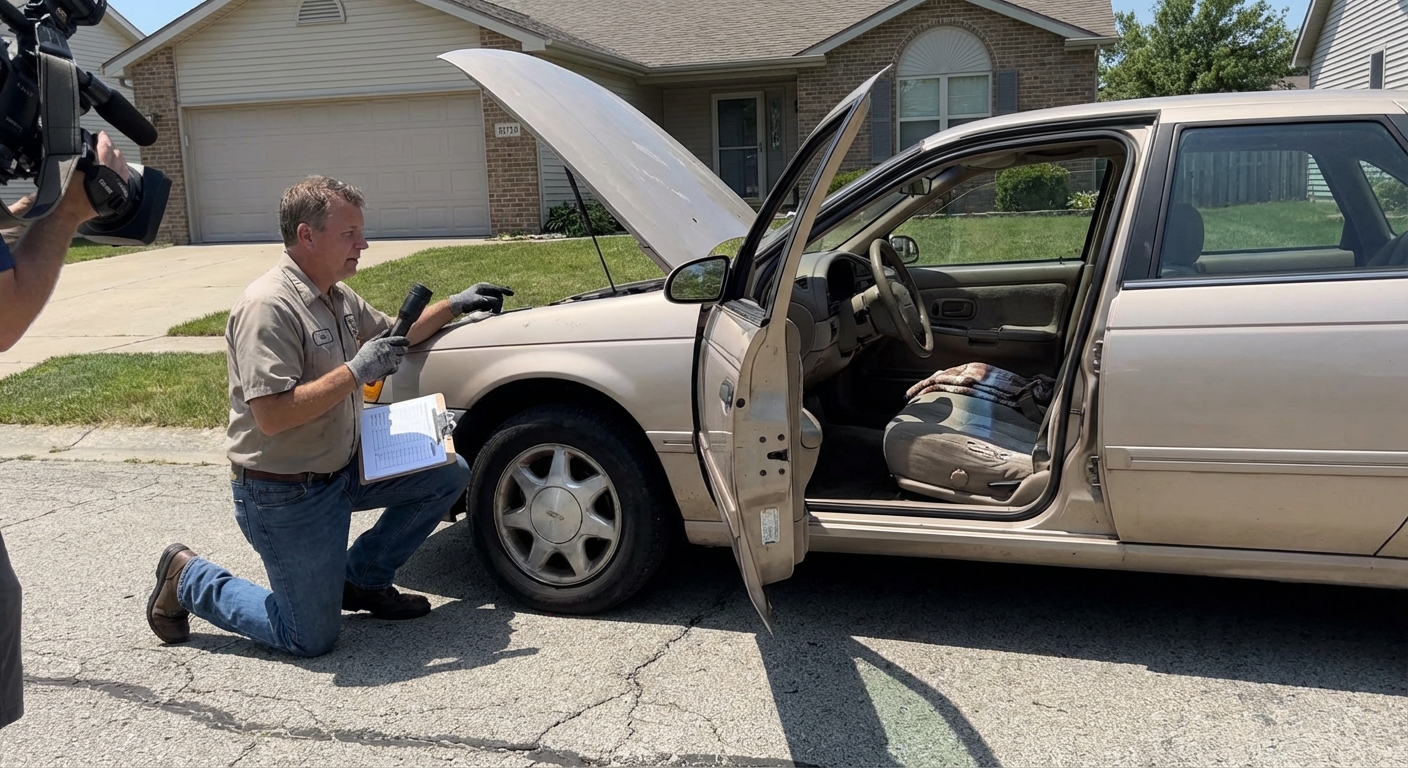

I recently followed a U.S. Marshals Service auction where a 3-year-old F-150, seized in a fraud case, sold for thousands under typical dealer retail. The catch? No test drive, limited inspection, and sold strictly as-is.

2. Bank Repos and Lease Returns

These are usually cleaner: owners missed payments or the lease ended. Sites like Manheim (dealer-focused), ADESA, and consumer-facing platforms like Copart and IAAI list tons of these.

In my experience, repo units can be either great deals or nightmares. One repo sedan I tested had perfect photos… but smelled like 3 years of chain-smoking and energy drinks. You don’t smell that through Wi‑Fi.

3. Insurance and Salvage Vehicles

These are the cars you see labeled “salvage,” “rebuilt,” “total loss,” or “flood”. They’re usually:

- Post-accident

- Flood damaged

- Hail damaged

- Theft recovered

For hobbyists, rebuilders, and exporters, this is paradise. For someone who just wants a normal daily driver, it can be a money pit.

How Online Bidding Actually Works

Most platforms follow a similar pattern. Here’s how a typical auction goes, step by step, based on how I’ve actually used them.

Step 1: Registration and Verification

You don’t just create an account and start throwing bids around. Many sites require:

- Government ID upload

- Credit card on file

- Sometimes a refundable deposit (often $400–$1,000 or a % of your planned limit)

Some auctions (like certain salvage sites) also require a dealer license or a broker if you’re a regular consumer. When I tested Copart as an individual, I had to either limit myself to certain “public” sales or use a broker who charged their own fee.

Step 2: Researching the Car (This Is Where Most People Lose)

Before I bid on anything now, I do a 4-part check:

- VIN check – I pull a report using the VIN (Carfax, AutoCheck, or a cheaper alternative). I’ve seen cars listed as “minor damage” that were previously declared total losses in another state.

- Photos, all of them – Zoom in on:

- Gaps between body panels

- Tire wear (uneven wear can hint at suspension or alignment issues)

- Undercarriage shots for rust or leaks

- Condition report – Auction houses use terms like:

- Run & Drive – Starts and moves under its own power (doesn’t mean it’s roadworthy)

- Enhanced Vehicle – They’ve tried to make it presentable (jump-start, maybe a wash)

- Stationary/Non-Runner – You’ll need a tow, full stop

- Title status – Clean, salvage, rebuilt, certificate of destruction, etc. Title status massively affects:

- Whether you can register it normally

- Insurance options

- Resale value

When I ignored title status once and bought a theft-recovery car with a salvage title, I saved thousands up front… and then found out full-coverage insurance was either insanely high or unavailable. That discount evaporated fast.

Step 3: Setting a Max Bid (And Actually Sticking to It)

Auctions play on emotion. You’ll see:

- Live bids ticking up in real time

- Countdown timers pausing and extending in the last seconds

I force myself to calculate my true max price before I bid:

True Max Price = Purchase price + Buyer’s fee + Other fees + Transport + Estimated repairs + Registration/TaxesThen I set my max bid lower than that number so I have room for surprises. Once, on a GSA auction, I walked away from a Ford Explorer I wanted badly because the price crossed my max by just $250. Two weeks later, a similar one popped up and I actually got it for less.

Emotion is expensive.

Step 4: Bidding Formats You’ll See

- Timed auctions – Bids are placed over hours or days. Highest bidder at the timer’s end wins (unless there’s a reserve).

- Live auctions with online access – A physical auction is happening, but you’re bidding from your laptop or phone.

- Buy It Now / Make Offer – Some repos and fleet units have a fixed “buy now” price. I’ve sometimes scored better deals by submitting a reasonable offer after a no-sale auction.

The Real Cost: Common Auction Fees

The winning bid is only part of what you’ll pay. The first time I won, I was shocked when my $5,000 “deal” turned into nearly $6,200 out the door.

Here are the fees I see most often:

1. Buyer’s Premium

This is the big one. Many auction houses take a percentage of your winning bid, often:

- 5–12% of the sale price

- Sometimes with a minimum (e.g., $250) and/or a sliding scale

On a $10,000 car, a 10% buyer’s premium adds $1,000 instantly.

2. Online / Internet Bid Fee

Some older-school auction platforms charge an extra flat fee just because you bid online instead of in person. It might be $50–$200 per vehicle.

3. Documentation & Title Fees

This covers paperwork processing and title transfer. I’ve paid anywhere from $75 to $400, depending on the seller (especially banks vs. government agencies).

4. Storage and Late Pickup Fees

Auctions run like clockwork. You usually get a window of 2–5 business days to pick up the vehicle after payment.

Miss it, and you may pay a daily storage fee. I once got hit with $35/day for three days because my transporter was delayed. Lesson learned: I now line up transport before I bid.

5. Broker / Agent Fees

If the auction isn’t open to the public, you might need a licensed dealer or broker. They’ll add their own fee, sometimes a few hundred dollars per vehicle.

6. Transport Costs

Unless you’re buying local and driving it home (if it’s drivable and street legal), you’ll need a tow truck or transport company. For me, typical U.S. domestic transport has been:

- Short distance: $150–$400

- Cross-country: $700–$1,400 depending on distance and season

Pros and Cons: Is It Actually Worth It?

After a few rounds of wins and near-regrets, here’s how I see the trade-offs.

Why Online Auctions Can Be Awesome

- Lower prices: Especially for high-mileage fleet vehicles, repos, and oddball models dealers don’t want on the front row.

- Huge selection: You can browse hundreds or thousands of cars in a few hours.

- Access to specialty stuff: Police interceptors, construction trucks, ex-government vehicles, and rare trims.

- Transparency of history (sometimes): Fleet vehicles often come with maintenance logs. GSA auctions, for example, typically list service history, which is gold.

Why They Can Also Suck

- As-is, no warranty: No cooling-off period, no returns. Once you own it, every problem under the hood is your problem.

- Limited inspection: Many auctions won’t let you do a full mechanical inspection. Some don’t even allow starting the vehicle.

- Opaque fees: Fee structures aren’t always obvious until checkout.

- Financing limits: Traditional lenders can be hesitant about salvage titles or auction purchases. You may need cash or a personal loan.

In my experience, auctions work best if either:

- You’re comfortable assessing risk and budgeting for repairs, or

- You have a trusted mechanic/body shop lined up who loves a good project

If you’re expecting a perfectly detailed, warrantied, ready-to-go car at half the price of a dealership, you’re going to be disappointed.

Red Flags I Never Ignore Anymore

Here’s my personal non-negotiable list after a few too many late-night “what have I done” moments:

- No clear photos of the driver’s side – Hiding something.

- Title listed as “other,” “pending,” or “certificate of destruction” – Usually a paperwork nightmare.

- Fresh undercarriage paint – Sometimes a sign of rust or damage being prettied up.

- No keys on a modern car – Replacing keys and programming modules can run into hundreds.

- Flood markers – Rust on seat rails, silt in trunk, foggy headlights from inside. Flood cars can look fine and die electronically later.

If two or three of those stack together, I walk away. There’s always another auction.

Basic Strategy for Your First Online Car Auction

If you’re just getting started, here’s a simple roadmap I wish I’d used for my first purchase:

- Start with public, non-salvage auctions – Government surplus or bank repos are usually more straightforward than heavy salvage.

- Watch 10–20 auctions before bidding – Track sale prices vs. book values. You’ll quickly see patterns.

- Do a sample cost breakdown – Pick a car, pretend you win, and calculate all fees + transport + probable repairs. Get comfortable with the math before real money is on the line.

- Bring a mechanic friend for preview day (if allowed) – A 20-minute walk-around by someone who knows what they’re looking at can save thousands.

- Bid on your second- or third-favorite car, not your dream car – You’ll make rookie mistakes. Better to learn them on something you like, not something you love.

When I finally did this intentionally—budget set, transport ready, VIN checked, realistic expectations—I ended up with a slightly rough-around-the-edges ex-fleet SUV that’s still running strong years later. All-in, I was about 30–35% under local retail, even after repairs.

Not every auction car will be a win like that. But if you treat it like a calculated risk instead of a lottery ticket, online vehicle auctions for seized and used cars can be one of the most powerful tools in a car buyer’s playbook.

Sources

- USA.gov – Government Car Auctions – Overview of U.S. government surplus and seized vehicle sales

- GSA Fleet Vehicle Sales – About Vehicle Sales – Official information on U.S. federal fleet auctions

- Federal Trade Commission – Buying a Used Car – Guidance on used car buying, risks, and protections

- Forbes – What Is A Salvage Title Car? – Explanation of salvage titles and implications for buyers

- Insurance Information Institute – How Car Insurance Works for Salvage and Rebuilt Vehicles – Insurance considerations for salvage and rebuilt-title cars